Dear Subscriber,

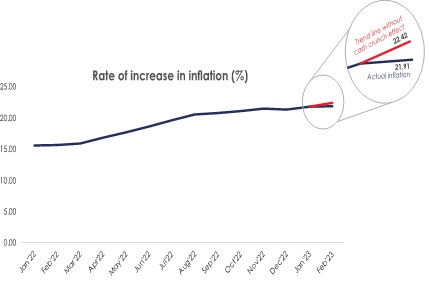

Nigeria’s headline inflation remained virtually flat creeping up by a mere 0.09% to 21.91% in February. The marginal increase in inflation was against the trend that would have seen an estimated increase of 22.41% all things being equal. February was a bizarre month in Nigeria, where a sudden extinguishing of 75% of cash in circulation almost brought the economy to a screeching halt.

It was widely expected that inflation would decline by 0.86% to 20.96% as a result. However, rather than fall, inflation stayed flat. Meanwhile, month-on-month and core inflation declined by 0.16% and 0.32% to 1.71% and 18.84% respectively. There are various reasons for this outcome but one of the principal factors responsible for this moderation in inflation was a sharp drop in the velocity of circulation of money outside the banking system. Nigerians, all of a sudden, saw the exaggerated effect of cash on the trading sector (wholesale and retail). Most noticeable is the impact of tips at various points in the service value chain from restaurants to bars and police checkpoints. Businesses were virtually paralyzed because of the cash effect on the economy. But now that both old and new denominations will remain legal tender, the reverse of the inflation expectation is likely to occur. That is a surge in inflation to higher than 22.5% in March and April.

In the download, the FDC Think Tank analyzes the February inflation number and its impact on businesses and the economy.

Enjoy your read…