Dear Subscriber,

The slow but painful recovery of the naira

The massive foreign exchange depreciation has left Nigerians mostly feeling pessimistic, some skeptical, and others indifferent about the national currency. Many had written off the naira as a basket case, with the view that nothing good could come out of Nazareth. However, Goldman Sachs, arguably the top global investment banking firm, forecasts that the naira will appreciate to N1,200/$ by the end of 2024. Evidently, there are signs that the naira is beginning to limp out of the doldrums, offering some hope to the mostly skeptical. In the last four weeks, the naira has gone from a sharp depreciation (N1,915/$) to a form of flat lining (N1,610/$) and is now on a slow and painful path to recovery.

This improvement can be partly attributed to a number of factors, including the CBN’s tight monetary policy, raising its MPR by 400bps, a marginal increase in forex supply, and the sanitization of the forex market, with the CBN barring 4,173 BDCs for non-compliance with regulatory provisions. This has offered flickers of hope at the end of a dark tunnel. However, rebuilding confidence is a slow, arduous, and excruciating process compared to the faster pace of the fall in investor confidence in the case of a dramatic event. Hence, the naira is not expected to recover as fast as it fell, and we forecast it to regain some of its lost value before the end of Q2 ’24.

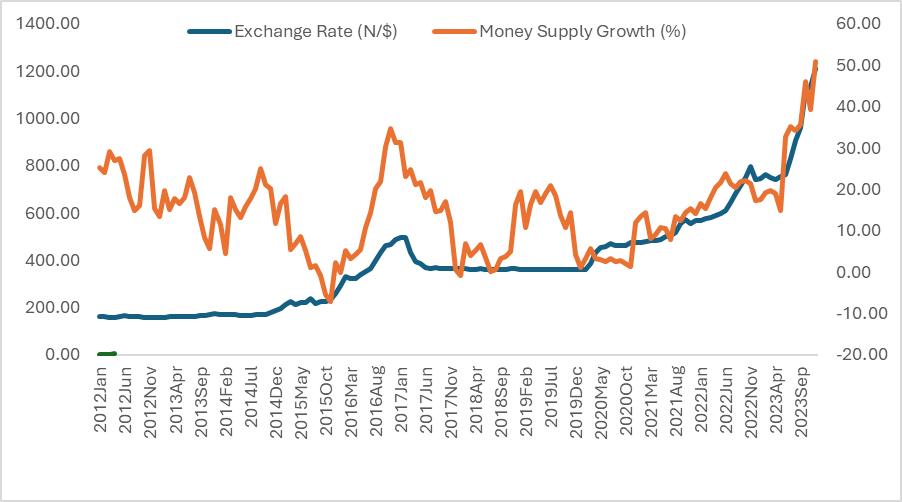

To bolster the recovery of the naira, the steps likely to be taken include refinancing existing commercial debt obligations (external), an increase in oil production and revenues, a more efficient capture of diaspora remittances & investment flows, and further money supply tightening. Money supply growth has emerged as an important driver of robust forex demand in Nigeria and is worth further investigation. In January 2024, the broad money supply increased by 76% (yoy), with the naira depreciating by 50.78% in the same period. This trend has persisted in the past 3 years, with a correlation of 0.48 in Nigeria. The surge in money supply has triggered an uncontrolled demand for dollars, outstripping the available supply and escalating the pressure on the naira.

This dynamic is not peculiar to the country; other Asian and Latin American countries like Argentina, Brazil and Indonesia experienced this trend, with 0.58, 0.68 and 0.43 correlation between money supply growth and exchange rate depreciation. But with solid monetary and fiscal policy alignment, semblance was restored to forex markets as money growth declined. Therefore, the Central Bank of Nigeria (CBN) faces the imperative task of addressing this monetary imbalance. The proposed solution entails a commitment to single-digit money supply growth, involving a significant elevation of short-term interest rates and assertive open market operations.

In this latest edition of FDC Prism, the Think Tank in-depthly analyses these recent economic shifts, shedding light on what lies ahead for Nigeria in the coming weeks.

Enjoy your read!