Dear Subscriber,

CBN remains resolute despite “sharp” drop in inflation

In the last four weeks, investors were roiled by the unexpected postponement of the MPC meeting and the uncertainty surrounding the direction of interest rates. As if that was not bad enough, the release of the rebased and revised consumer basket added to the controversy as to what is the real rate of inflation in Nigeria.

One data point is not a trend

Conventional logic dictates that when in difficulty, defer your decision. That is what the Cardoso team did. Believing strongly in the principle that one data point is not a trend, the MPC voted unanimously to wait a little to see how real this sharp drop in inflation is. Picking his words very carefully, he said “our response will be gradual.” That is the smart thing to do to differentiate between the noise and the data.

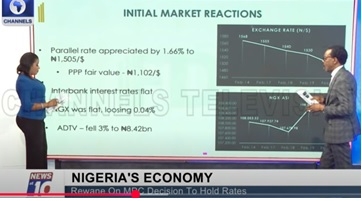

Traders in jitters

The interbank market had expected interest rates to fall and liquidity to increase. This did not happen. The naira has gained 1.66% in the last 24 hours but is falling again. We expect interest rates to remain sticky whilst the market digests the real meaning of the revised basket. Our analysis suggests a more normal reduction in price inflation than the radical picture painted by a 10% drop in one month. Between now and May 19 (MPC’s next meeting), traders will be on tenterhooks and biting their nails as the market swings.

Like they say, plastic surgery enhances the appearance but not the quality.

The above issues were analyzed by Bismarck Rewane on Channels TV’s News at Ten.

The video link and slides are attached.

Enjoy your read.