Dear Subscriber,

The CBN remains hawkish

At its second meeting for the year, the Monetary Policy Committee (MPC) maintained its hawkish stance, raising the benchmark interest by an additional 200bps to 24.75% after the 400bps increase in February. The bank reverted the asymmetric corridor to +100/-300bps from +100/-700bps and retained the liquidity ratio and CRR at 30% and 45%, respectively. This move signals the CBN’s unrelenting efforts to rein in inflation, which stood at 31.7% in February, stabilize the naira further (N1,309/$), slow money supply growth (79% y-o-y), and bolster investor confidence.

Mixed implications of higher interest rates

The interest rate increase is expected to support investment inflows, mainly from portfolio investors, in the near term. Between January and February 2024, FPI inflows have surged 58%. This, combined with the 4x rise in remittance inflows and rebounding oil and non-oil export earnings, will support external reserves, aiding the CBN’s intervention efforts at the official window.

The CBN’s orthodox stance also hints at higher-for-longer effective interest rates, signaling more attractive yields on fixed-income instruments and a rocky performance of the NGX. Conversely, the high-interest rate environment does not hold promise for the private sector seeking credit for business expansion in the near term. While this trade-off is imminent during inflationary times, it is worth considering at the next MPC meeting to prevent the economy from overheating amid rising poverty levels, shrinking productivity, and dwindling consumption.

Essentially, the naira’s stability will continue amid higher interest rates. However, it will take time for exchange rate gains to translate to reduced commodity prices in the open markets, indicating a prolonged period of the cost of living crisis in the short term. Still, the future holds bright promises. As they say, it’s not over till the fat lady sings!

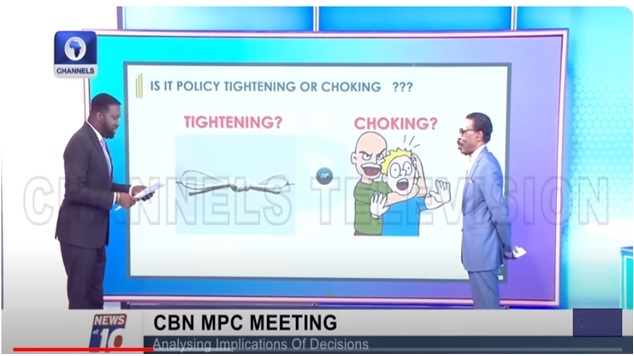

In an interview on Channels TV, Bismarck Rewane comprehensively analyzed the MPC’s decision on March 26, 2024.

The video link and slides are attached.

Enjoy your read!