Dear Subscriber,

CBN keeps up the pressure

The MPC met against a background of rising inflation, naira falling in the forex market, and expectations of a planned protest. Decisions were targeted at curbing the naira’s weakness and bringing inflation under control.

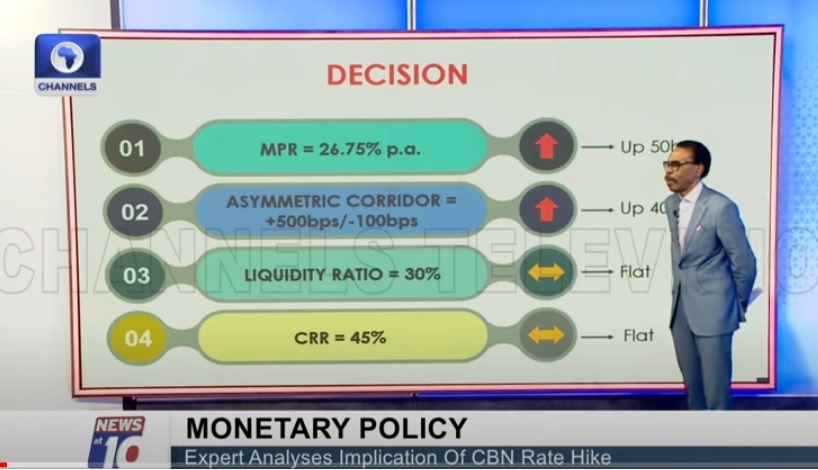

Against most expectations, MPC increased the MPR by 50bps to 26.75% p.a., the 12th time in 3 years, and drastically adjusted the asymmetric corridor for banks borrowing from the CBN window to +500/-100 from +100/-300.

What does the asymmetric corridor mean?

It means that a bank can either raise money from the market to bid for forex or borrow from the CBN window to finance its forex demand. On the assumption that the banking industry total borrowing at the window is N3trn for the year, this will increase the carrying cost of borrowing to N960bn a year, thus reducing the aggregate demand for US dollars in the Nigerian market.

MPC signals and markets react

After MPC’s announcement, the naira fell sharply to N1,687/$ but quickly regained all its losses and has now stabilized around N1,590/$. We believe that the naira is likely to appreciate towards N1,500/$ before September.

In an interview on Channels TV News at Ten program, Bismarck Rewane analyses the implications of the MPC decision on the various sectors of the economy and your business.

The video link and slides are attached.

Enjoy your read.